Social credit scores, given based on the ethical behaviour of people, aim to reduce the crime rate and can be used to incentivize their citizens.

Imagine that your everyday actions, like paying your bills on time or following traffic rules, shape a score that affects your access to services. Not a financial credit score, but a social credit score. It sounds like a futuristic idea. But in some parts of the world, it’s already a reality. With technology evolving so fast, the question arises: could social credit systems be introduced in your country too?

A social credit score is a mechanism that evaluates people based on their behavior, both online and offline. Unlike a regular credit score, which only tracks how you manage your money, a social credit system looks at your overall conduct. It might include:

In short, it is a way of measuring how “trustworthy” a person is in society, according to certain rules set by authorities.

The use of social credit scores varies by system. In countries where it is being tested, these scores can impact:

In short, it touches many areas of life, not just your wallet.

It is not as far-fetched as it may seem. Many countries already collect large amounts of data through government and private platforms. From biometric IDs to digital tax records, our footprints are everywhere. So, technically, the infrastructure to create a social credit system already exists in many places. Here is how it could happen:

If your country uses digital ID cards or online platforms for public services, it means your activities are already being logged. These systems can be the starting point for tracking citizen behavior.

When different services, like banking, healthcare, and traffic management, start sharing data, it becomes easier to create a single score based on your actions across all areas.

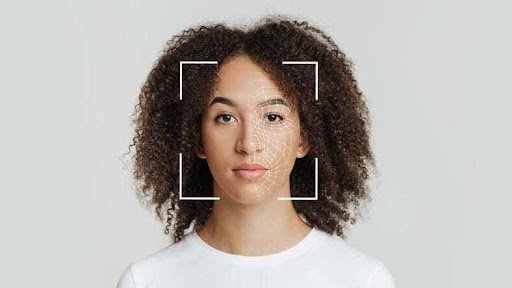

Many countries already use cameras and face recognition in public places for safety. These tools can also be used to track behavior, like jaywalking or littering, feeding into a social rating system.

Large tech platforms already rank users in subtle ways. For instance, customer ratings on ride apps or feedback scores on e-commerce sites. These systems could be expanded or connected to form a bigger picture.

However, such a system also raises big questions. Who controls the score? What counts as “good” or “bad”? Can you challenge your score? These are issues every country must consider before moving forward.

While the technology to create social credit scores already exists, whether or not it should be used is another matter. Data can help build safer, more honest societies. But it also risks taking away freedom and privacy if not handled with care.

Tech companies must focus on transparency, fairness, and accountability if they ever work with such systems. There must be clear rules and checks in place. Citizens should know what data is being used and have the right to appeal or correct their scores.

Social credit scores may sound like something out of a movie, but they are slowly becoming part of real-world conversations. With more digital systems in place, it is not about whether it can happen, but how and why it might be done.

As individuals, we should stay informed and ask questions. As tech creators and service providers, we must build tools that respect people and their rights. In the end, technology should support trust, not control it.

References:

https://en.wikipedia.org/wiki/Social_Credit_System

https://hai.stanford.edu/news/hai-fellow-shazeda-ahmed-understanding-chinas-social-credit-system

Creemers, Rogier. “China’s Social Credit System: An Evolving Practice of Control.” SSRN, 2018.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3175792

Kshetri, Nir. “China’s Social Credit System: Data-Driven Governance for a ‘New Era.’” Communications of the ACM, Vol. 62, No. 1, January 2019.

https://cacm.acm.org/magazines/2019/1/233758-chinas-social-credit-system/fulltext

The Brookings Institution. “China’s Social Credit System: A Mark of Progress or a Threat to Privacy?”

https://www.brookings.edu/articles/chinas-social-credit-system-spreads-to-more-daily-transactions/

World Economic Forum. “Digital Identity: The Future of Identity in a Digital World.”

https://www.weforum.org/reports/digital-identity-the-future-of-identity-in-a-digital-world

Brookings Institution. “How AI Can Enable Mass Public Surveillance.”

https://www.brookings.edu/articles/how-ai-can-enable-public-surveillance/

Wired. “How Your Uber Rating Could Affect Your Life.”https://www.wired.com/story/uber-rating-reputation-score/

Future of Privacy Forum. “Ethical Data Use in Government.”

https://fpf.org/publications/ethical-data-use-in-government/

The Verge. “The Ethics of Big Data and AI.”

https://www.theverge.com/2020/12/16/22179447/ai-ethics-data-collection-bias-privacy

The Conversation. “Social Credit Systems: Technology is Here, But Should We Use It?”https://theconversation.com/social-credit-systems-the-technology-is-here-but-should-we-use-it-131240